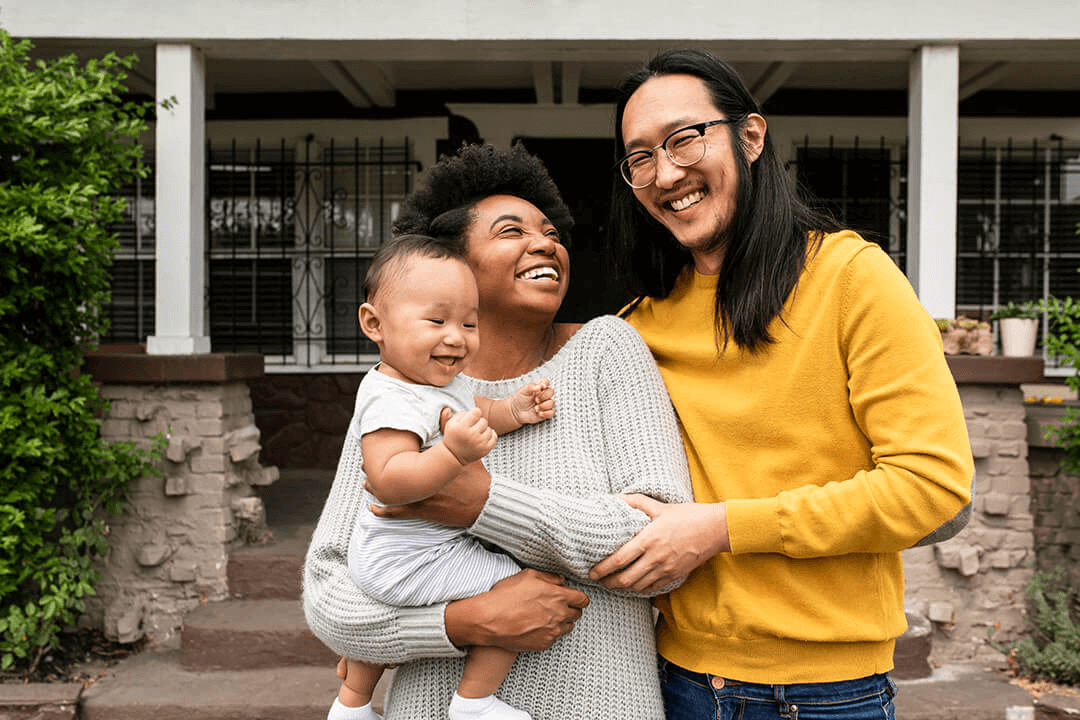

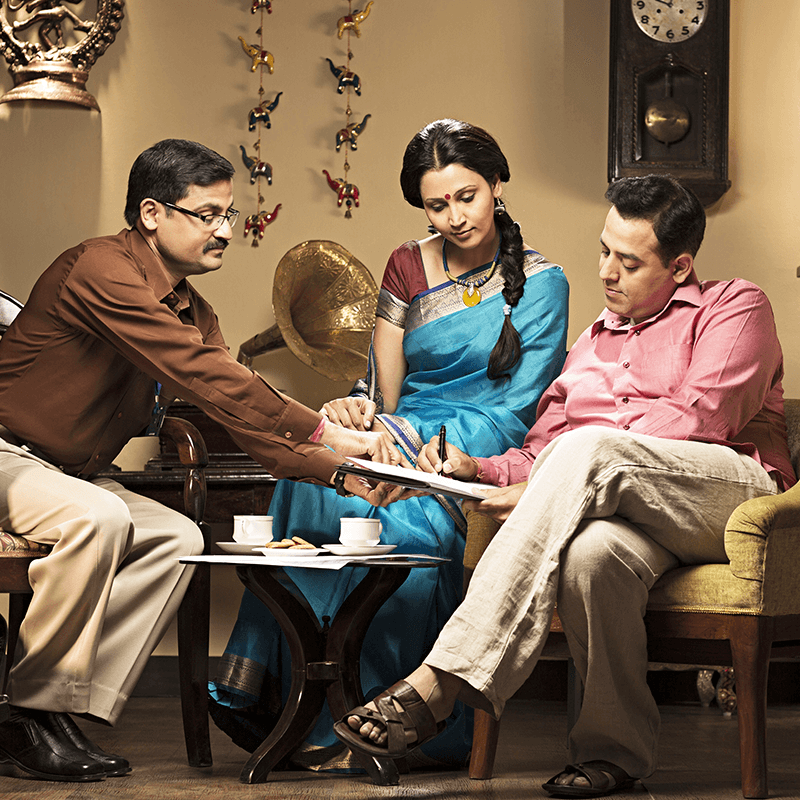

From Procrastination to Protection

Don't put getting life insurance on the back burner.

Life insurance is a vital financial tool that should not be overlooked or postponed. Delaying this critical decision can have significant consequences for you and your loved ones. Here’s why acting sooner rather than later is essential and the benefits it brings.